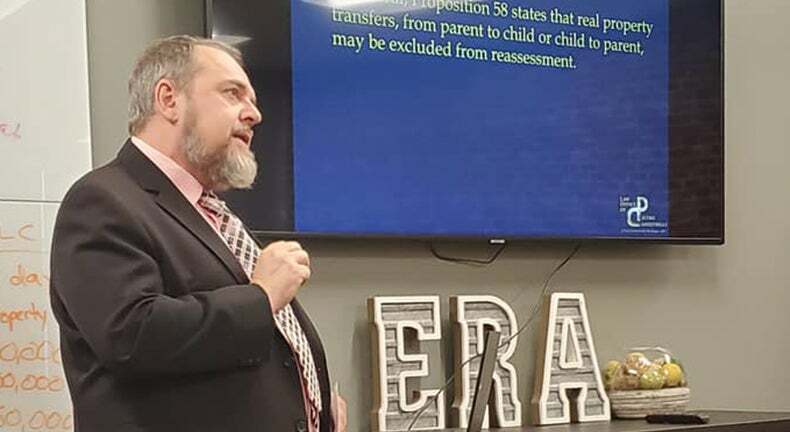

Tax Education & Speaking Engagements

Attorney Pietro E. Canestrelli provides insight into many areas of law that effect business owners.

Welcome to the Tax Controversy Boutique, APC, at the Law Office of Pietro Canestrelli. We are committed to offering owners of small and medium-sized businesses superior advice. Our goal is to arm you with the information and techniques needed to navigate the intricate world of taxation successfully. We have assisted many companies in Temecula, California, and San Diego, California, in achieving financial stability and tax law compliance with our knowledge and dedication to customer success.

Why Tax Education Is Important

Running a business involves paying taxes, and knowing the rules and best practices for doing so is essential to your financial security. The complexity of the law often overwhelms business owners, resulting in mistakes, missed opportunities, and unwarranted fines. By making an investment in education, you may give yourself the tools you need to make wise choices, maximize deductions, reduce payments, and deal with any potential related concerns.

The Benefits of Tax Education

1. Maximizing Deductions: Did you know numerous deductions available to business owners can significantly reduce their taxable income? Understanding the intricacies of the law can help you identify and take advantage of these deductions. Attending our education seminars and workshops will give you valuable insights into the deductions specific to your industry, ensuring you don't miss out on potential savings.

2. Minimizing Liabilities: As a business owner, minimizing levy liabilities is essential for maintaining a healthy bottom line. By learning about levy planning strategies and techniques, you can proactively structure your business and finances to minimize your obligations legally. Our program will provide practical tips and guidance on effective planning, allowing you to keep more of your hard-earned money.

3. Avoiding Costly Mistakes: The consequences of related errors can be severe, including penalties, interest, and legal consequences. By educating yourself on the laws and regulations, you can avoid common mistakes that often lead to audits or disputes with the Internal Revenue Service (IRS). Our team of experienced attorneys, led by Pietro Canestrelli, will equip you with the knowledge necessary to ensure compliance with laws and avoid unnecessary complications.

4. Handling Tax Controversies: Despite your best efforts, you may find yourself facing a controversy or dispute with the IRS. Our program will help you prevent such issues and provide the necessary guidance to address them effectively. With our expertise in tax controversy resolution, we can assist you in navigating audits, appeals, collections, and other related disputes, ensuring the best possible outcome for your business.

Speaking Topics

- Tax

- Tax Controversy 101

- Business Planning

- Navigating California Worker Laws

- Compensation Issues For Businesses

- Disastrous Consequences Of Mismanaging Your Non-Profit And Practical Solutions To Common Mistakes

- 1099 Versus Employee Business 101

- Common Avoidable Tax Mistakes For Businesses

- Best Practices For A Tax Audit

- Taxation Of Real Estate Transactions

- Tax Law Updates

Educational Resources and Seminars

At the Law Office of Pietro Canestrelli, we believe in the power of education. We offer a variety of resources to help small and medium-sized business owners expand their knowledge:

1. Seminar and Workshops: Our seminars and workshops cover various topics, including planning strategies, deductions, compliance, and dispute resolution. These events provide an interactive and engaging learning experience, allowing you to ask questions and gain valuable insights from our team of experts.

2. Blog: Our regularly updated blog features informative articles and case studies on related topics. We share practical tips, real-world examples, and the latest updates in law to keep you informed and empowered.

3. Supporting Articles and Resources: We have compiled various supporting articles and resources from reputable sources to complement our educational offerings. These resources cover various related subjects, providing additional insights and perspectives. Information on Tax Compliance

The IRS expected the gap for 2016—the difference between taxes owed and taxes paid—to be $496 billion. This emphasizes the significance of compliance and corporate education requirements. Due to their limited financial resources and lack of law understanding, small and medium-sized firms are particularly susceptible to non-compliance with rules.

A key element of managing a successful business is education. It can assist you in keeping accurate records, planning for bills, avoiding penalties, and defending your company in the event of a tax audit. The Law Office of Pietro Canestrelli is dedicated to offering small- to medium-sized business owners in Temecula and San Diego, California, useful education. To find out more about our workshops and seminars, get in touch with us right away.

Contact Our Firm