Representation for Owed IRS Back Taxes

Understanding Potential Repercussions and Finding Solutions

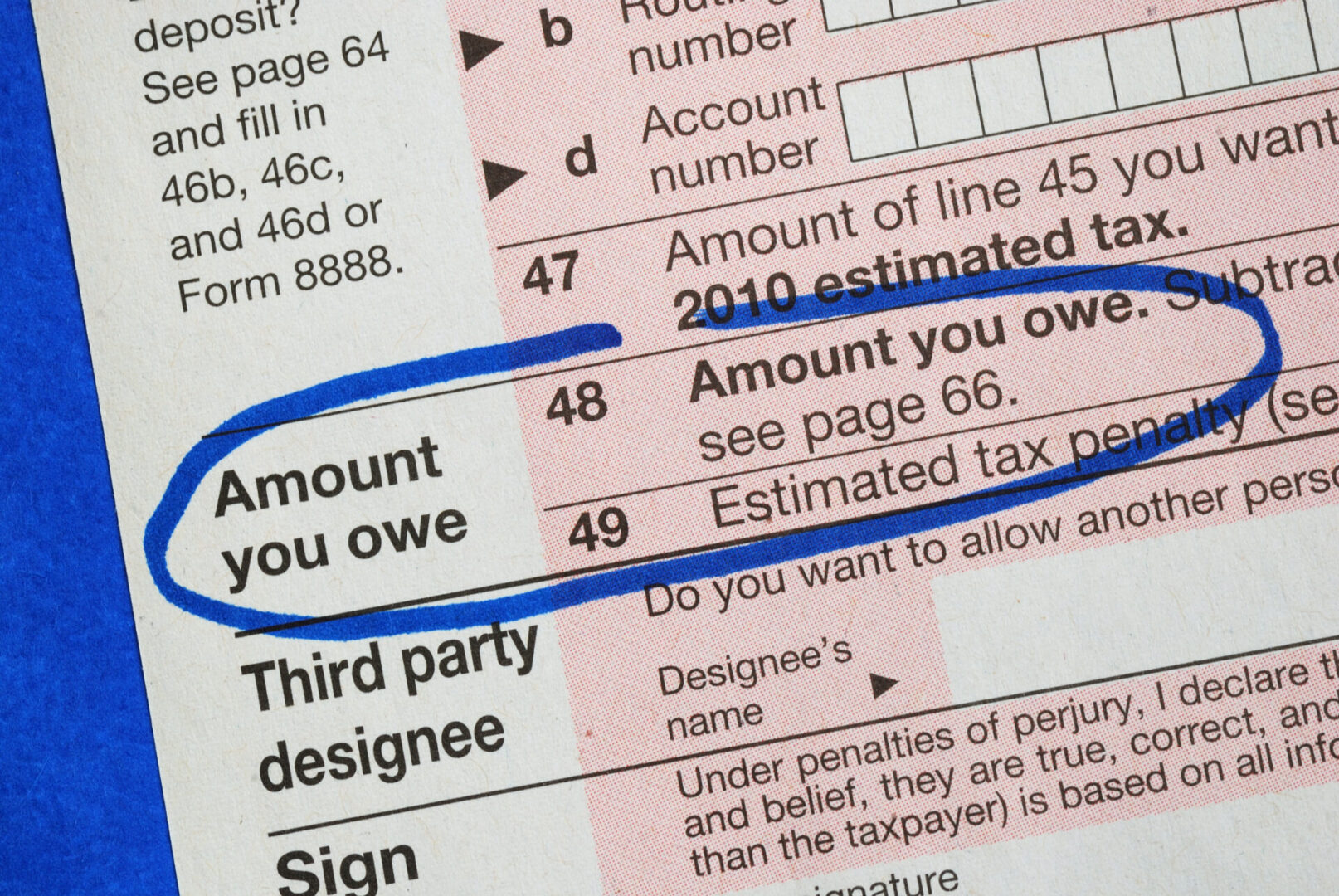

Encountering tax issues, especially owed taxes, can be a stressful and daunting situation for individuals and businesses alike. Unpaid taxes can lead to various repercussions, ranging from financial penalties to legal actions by the Internal Revenue Service (IRS). Understanding the implications of owed taxes and exploring potential solutions is crucial in addressing these challenges effectively.

Understanding Owed Back Taxes

Owed taxes occur when an individual or entity fails to pay the full amount of taxes owed to the government by the specified deadline. These unpaid taxes can stem from various reasons, such as underreporting income, failure to file tax returns, or inaccuracies in tax calculations.

Potential Repercussions of Owed Taxes

Accumulation of Interest and Penalties: The IRS imposes interest and penalties on unpaid taxes. Interest accrues daily on the outstanding balance, while penalties may include late payment penalties, failure-to-file penalties, and accuracy-related penalties, significantly increasing the total amount owed over time.

IRS Collection Actions: Failure to address owed taxes can prompt the IRS to take collection actions. These actions may include issuing a tax lien, which places a claim on the taxpayer’s property, or a tax levy, which allows the IRS to seize assets, garnish wages, or levy bank accounts to satisfy the tax debt.

Legal Consequences: Persistent non-compliance with tax obligations can lead to legal consequences. The IRS has the authority to pursue legal actions, including civil lawsuits or criminal charges in severe cases of tax evasion or fraud.

Strategies to Address Owed Taxes

Payment Plans and Installment Agreements

For individuals or businesses unable to pay the full tax debt upfront, The Law Office of Pietro Canestrelli offers various payment options. Installment agreements allow taxpayers to pay off owed taxes in manageable monthly installments. These agreements provide a structured approach to gradually settle the tax debt while avoiding more severe IRS collection actions.

Offer in Compromise (OIC)

An Offer in Compromise is an option for qualifying taxpayers to settle their tax debt for less than the full amount owed. This solution requires demonstrating an inability to pay the full tax liability or proving that paying the entire debt would cause undue financial hardship.

Seeking Assistance from The Law Office of Pietro Canestrelli

Navigating owed taxes and the associated repercussions can be complex. Seeking guidance from The Law Office of Pietro Canestrelli’s experienced team can provide valuable insights and assistance in negotiating with the IRS, exploring available options, and formulating a strategy to address the tax debt.

The Importance of Resolving Owed Taxes

Addressing owed taxes is crucial to mitigate the potential repercussions and regain financial stability. Resolving tax debt not only prevents the accumulation of interest and penalties but also alleviates the stress of facing aggressive IRS collection actions or legal consequences.

Proactive Communication with the IRS

Open communication with the IRS is key. Proactively reaching out to the IRS, acknowledging the tax debt, and demonstrating a willingness to resolve the issue can often result in more favorable outcomes and potential relief options.

Contact Us

Owed taxes can have significant implications, ranging from financial penalties to legal actions by the IRS. Understanding the potential repercussions and exploring available solutions is vital for individuals and businesses facing tax debt. Seeking guidance from The Law Office of Pietro Canestrelli and taking proactive steps to address owed taxes can lead to more manageable solutions, alleviate stress, and prevent escalating financial and legal challenges.

At The Law Office of Pietro Canestrelli, our team specializes in assisting individuals and businesses facing tax-related challenges, including owed taxes. Contact us today for personalized guidance and effective strategies to address your tax concerns. Remember, addressing owed taxes promptly is key to regaining control of your financial well-being.

Contact Our Firm